The rooms to go credit card is a store card and most store cards usually aren t too hard to be approved for.

Rooms to go credit approval odds.

Below we list the furniture stores that offer fast and easy credit approval including information about the financing options and application process as well as some criteria you can use to choose the furniture store that best fits your needs.

Store cards are great for rebuilding credit.

I m new to credit i ve been using less than 30 of my limit and made my payments on time i m going on my second month and my score is 726 me and my partner just bought a home using her credit i would like to get furniture from rooms to go under my credit but should i even try since i ve only had credit for two months.

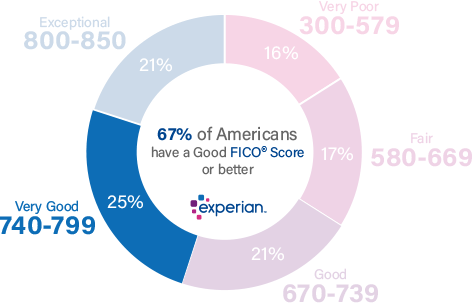

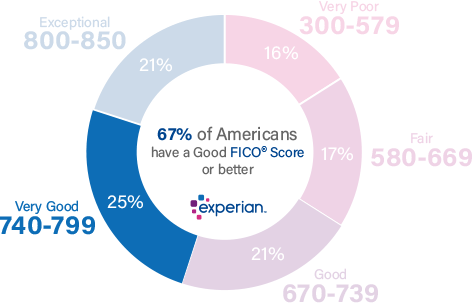

For this card we recommend applicants have average credit 630 689 or above for the best approval odds.

Synchrony car care manage all your car expenses gas tires repairs and maintenance with one card.

Smart features and free tools to help you get the most from your synchrony credit card.

Over a million locations.

See the credit options available from rooms to go online and store locations.

Synchrony home one card.

You have a better chance for approval with a credit score of at least 700 however if your credit history and income are in good standing you may still qualify for the credit with scores in the low to mid 600s.

We offer flexible credit for purchases online and at our showroom kids patio and outlet stores in addition to a rooms to go credit card.

I was excited to get approved but it got slightly tricky afterwards.

Rooms to go requires a down payment equal to sales tax and delivery.

Rooms to go credit is generally not extended to those who have credit scores lower than the mid 600s.

I didnt realize this until i was at the outlet store about to check out.

This is a synchrony bank credit card.

Sometimes it just makes sense to buy now and pay later.

So you can increase the amount of available credit and as long as you don t abuse it put yourself back on the road to a great credit score.

Saying no to what you want or giving in to unhealthy debt to get it.

While you still need to go through a credit check the criteria for these cards is usually easier to meet than the stricter normal credit cards.